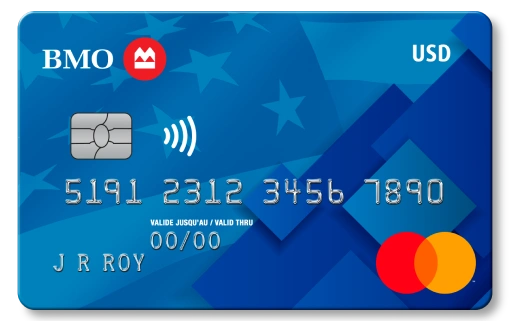

The BMO U.S. Dollar Mastercard®* provides a seamless way to shop in U.S. dollars, offering an escape from exchange-rate surprises. Designed for those who frequently make purchases in U.S. currency, this credit card ensures transactions are smooth and predictable.

Benefiting from a flat U.S. $49 annual fee, the card offers competitive interest rates and is accepted at millions of locations globally. A fantastic feature is the annual fee rebate for those spending U.S. $3,000 or more within a year.

The advantages of using a U.S. dollar credit card

One of the greatest advantages of using a U.S. dollar credit card is the ability to bypass unpredictable currency exchange rates. This financial tool is particularly useful for individuals who travel often or engage in online shopping through U.S.-based retailers.

By making payments directly in U.S. dollars, users are protected from the often unfavorably fluctuating exchange rates, ensuring more predictable financial planning. Additionally, paying U.S. dollar statements in U.S. funds simplifies transactions for dual-currency expense management.

Annual fee rebate and additional perks

For cardholders who meet specific spending thresholds, an appealing feature is the annual fee rebate. By spending U.S. $3,000 or more a year, the annual fee is rebated on the BMO U.S. Dollar Mastercard, effectively lowering the cost of keeping the card.

This benefit not only encourages active usage but also mirrors a form of savings for consistent shoppers. Simply put, the more you shop within this limit, the less you have to worry about covering yearly fees.

The card also offers attractive extras, from additional cardholder options at no extra cost to significant discounts on entertainment experiences, like Cirque du Soleil shows. Moreover, the card includes extended warranty and purchase protection, giving consumers peace of mind regarding their purchases.

Navigating the BMO PaySmart™ Installment Plans

To further enhance financial management, the BMO PaySmart™ feature transforms cumbersome payments into manageable monthly installments. This allows cardholders to convert purchases into smaller, low-cost payments, providing an immediate boost in purchasing power without the sting of high charges.

Practically speaking, this approach makes budgeting easier and smoother. Rather than being hit with large, inconvenient expenditures, individuals can control the pace of repayments. This gives consumers the flexibility to use their U.S. dollar credit card for large and small purchases alike, while easily managing their cash flow.

Applying for a BMO U.S. Dollar Mastercard

Applying for the BMO U.S. Dollar Mastercard is straightforward, taking as little as 60 seconds for an approval decision. Prospective users need to ensure they have the necessary financial information to expedite the process. Once approved, setting up online and mobile banking services is crucial for efficient card management.

These digital tools not only aid in transaction oversight but also enhance the safety and security of the card. Features such as card locking and unlocking and transaction monitoring help maintain control. For added convenience, users can also access their credit score for free.

Conclusion

The BMO U.S. Dollar Mastercard®* is an excellent choice for individuals looking to handle U.S. dollar transactions without the hassle of currency conversion. Its unique benefits, including global acceptance and financial incentives, make it a versatile option for travelers and online shoppers.

Ultimately, for those frequently dealing in U.S. currency, this card presents a flexible financial tool that consolidates cross-border spending into manageable routines. With the backup of Mastercard’s global network and the added security features of BMO, it stands out as a robust choice for anyone looking to streamline their financial interactions in U.S. funds.